2024 Hybrid Cars Tax Credit – The federal tax credit rules for electric vehicles often change, as they did on January 1, 2024. The good news is the tax credit is now easier to access. The bad news is fewer vehicles now qualify for . Plug-in hybrids are perfect for buyers who want to take advantage of the federal tax credit but are hesitant to take the full leap into an EV. As with EVs, plug-in hybrids (PHEVs) are now eligible for .

2024 Hybrid Cars Tax Credit

Source : www.npr.orgIRS Moves to Make EVs, Plug In Hybrids Immediately Eligible for

Source : rbnenergy.comEvery electric vehicle that qualifies for federal tax credits in 2024

Source : electrek.coElectric Vehicles: EV Taxes by State: Details & Analysis

Source : taxfoundation.orgOnly 13 Cars Qualify For 2024 EV Tax Credit Under New Rules

EV tax credits 2024: VERIFY Fact Sheet | verifythis.com

Source : www.verifythis.comEV tax credit

Source : smithpatrickcpa.comThe (Pretty Short) List of EVs That Qualify for a $7,500 Tax

Source : insideclimatenews.orgEV Tax Credit 2024: How It Works, What Qualifies NerdWallet

Source : www.nerdwallet.comThe $7,500 tax credit for electric cars is about to change yet

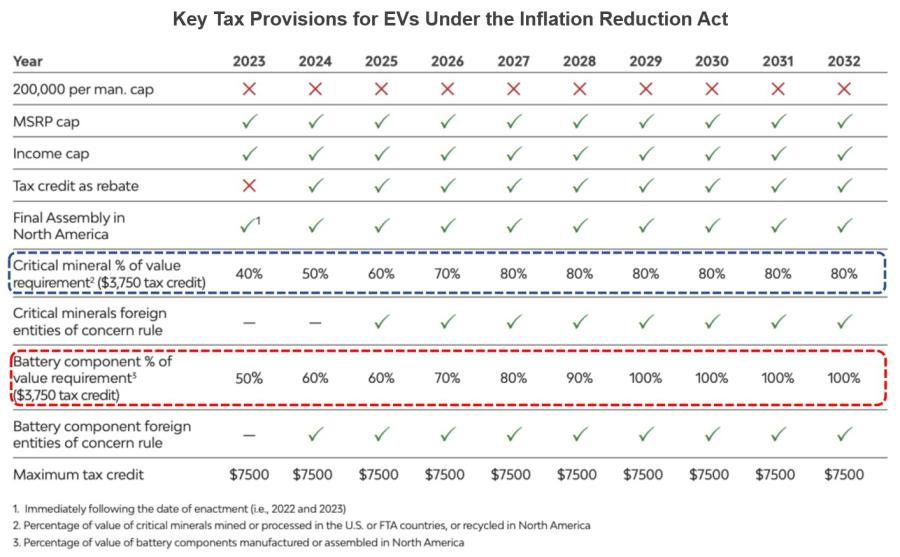

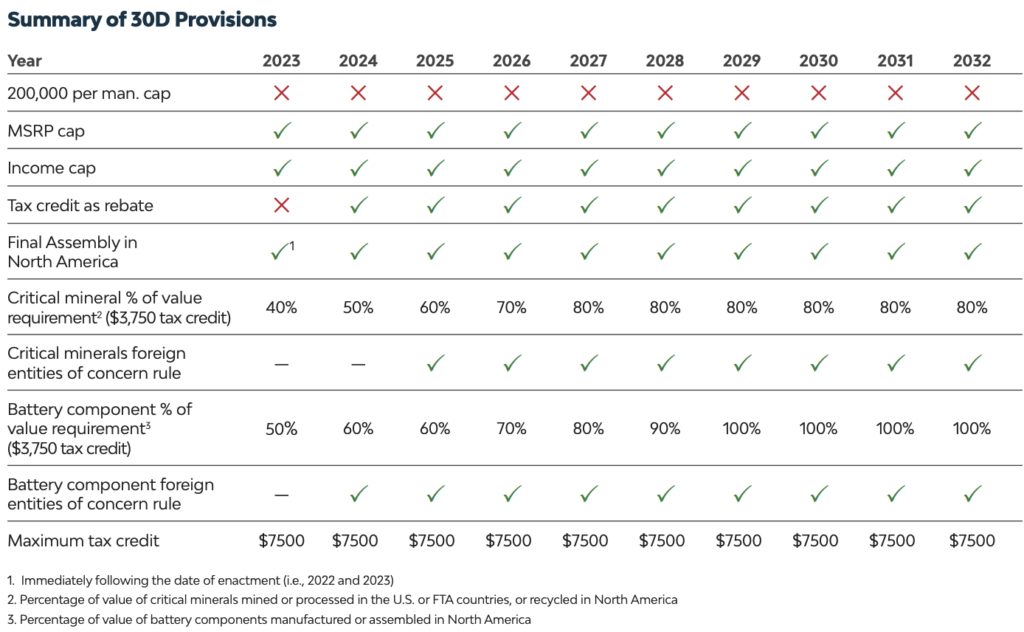

Source : www.npr.org2024 Hybrid Cars Tax Credit The $7,500 EV tax credit will see big changes in 2024. What to : The IRS recently announced updates to its $7,500 tax credit for electric vehicle owners. The changes reduce the number of electric and hybrid vehicles that qualify for the tax credit to 13, which is . Back in the distant past (just two months ago), we wrote a story outlining how few electric vehicles qualified for the full $7,500 federal tax credit for electric vehicles and plug-in hybrids. At the .

]]>